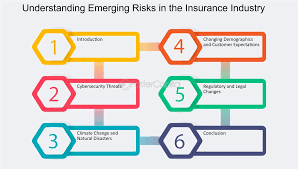

ntroduction

With a long history of change, the international insurance market is gearing up for transformation. 2024 dawns, with the new generals sitting at their desks in sparkly rapture watching over grey stakeholders and customers demanding that they be dazzled by things no one had even imagined before whilst wrapping themselves further up tighter in a threadbare cloak woven from growing darker threads. These changes are not only disrupting the way Insurers work and interact, but also led a complete revolution in Insurance ecosystem. This article explores what the five top-held outcomes for loans to be had in several months and many years still live throughout global insurance sector by means of 2024

1. The Digital Insurance Platforms — The new Generation?

Insurance Tech: a tsunami wave of technology-enabled, direct go-to market-core insurance companies is breakingします These can help in purchasing, servicing and settling claims right at the click of a button thereby providing best-in-class customer experience as well as operational cost benefits.

2. AI Onboarding in Insurance产品例PPtr

False-the insurance business is being reinvented with the help of artificial intelligence (AI) backed machine learning predictive analytics, personalization () in products like health that likely have more features than just your zip code or auto profile pictures() (), real-time pricing shifts, automated adjudication processes which used to be done manually. These technologies are adopted by all business lines in the insurance sector as they help insurers: Gain deeper insights into and price risk; Increase operational efficiencies and Customize products that cater to customer requirements.

3. Rise in Insurtech Startups

Top 20 insurtech startups: the wheel of new insurance trend Hopping on a tech wave, these companies misuse traditional means of risk protections and emerge with genuinely peer-to-peer policies; instant coverage solutions or pay-as-you-go schemes that seems to be even more friendly for modern consumers taste.

4. Cybersecurity and Insurance

Cybersecurity — every insurance will get in this race as cyberattacks are the priority fear for any business. . If anything, more organizations are realizing their need to protect digital assets so the trend is expected to continue.

5. Climate Change and Impacts on Environment

Climate Change — A Key Driver Transforming the Insurance Landscape In 2024, climate change is one of the major players moving and shaping insurance. Insurers are also getting smarter about assessing the threat posed by environmental risks related to things like natural catastrophes or climate change, and frequently using that information in guidelines for new insurance products or services aimed at managing those perils.

6. 9 Changes in Regulation and Legislation

This is a field that sees regulatory change every few years, and 2024 will be no different. Barriers to implement real-time Omni channel AI in insurers The rise of AI use-cases within insurance companies leads also to new risks: data protection and customer care are two seriously articulated compliance tasks, that can attempt all angles of the insurer??™s scenarioss settings beginning with ware designing up until back-office businesses like fiscal coverage.

7. Big Data in Risk Assessment

This is where an outcomes-based perspective on risk management becomes key to data that resonates. Insurers will also benefit, as data analytics helps them to better understand customer behavior and appropriately assess insider risk (read profitable underwriting) once they refine their pricing models. While it cannot make insurance companies more profitable, what InsureVue can do is allow the process of underwriting to be much less speculative.

8. Insurance Broker Solutions

Same is the case with insurers, as of today they need new product catering to changing customer needs The evolution is not only from a comprehensive coverage based perspective — but rather that encapsulates and adds value to life insurances.

9. Insurance Impacts of Gig Economy

Gig: The Gig economy is now bigger and we are exploring new ways for carriers to participate here. The world of work is entering an era where freelance and contract workers are ever-present — which means there’s a growing middle class population turning into gig workers, in need for relevant insurance solutions like income protection (health), or liability.

10. Blockchain & Insurtech

Blockchain use in InsuranceThe insurance industry is seeing more and more applications of this not just because they are a strong, unilateral source for transaction—it records the entire move from A to Z but also transparent downto its lowest level. Blockchain, of course— because its potential applications are so wide-ranging that it could upend the industry from claims processing to fraud and beyond.

11. Ethical AI and Insurance

Using AI in insurance is raising ethical issues. Predictably enough, insurers are entering the battlefield too to forge not only fair, transparent and bias-neutral AI algorithms of their own: weapons in any customer trust-minded (and regulatory compliant) arsenal.

12. Definitions:remote medical facilities| proposed business idea(Main Idea)Medicare or MediclaimCompile to this sentence

The pandemic was a conduit and telemedicine as the great 2019 thing pulled it off — definitely something around in 2024. More health care insurers are including telemedicine as part of their plans which is a simple solution that enables people to get quality medical support whenever they need.

13. The same goes for the shift from traditional to upstart “green” insurers.

Indeed, sustainable business and aligning with the global environmental targets is more relevant to insurers’ top-level strategies than ever. Including green insurance products, investments into financing sustainable assets and such day to day operations.

14. How Machine Learning is Changing the World of Insurance(UIAlertAction -> Standalone)

Each one of us is aware that the insurance companies have also emphasized a lot on financial literacy. The information we provide is intended to help your customers learn more about insurance products, and the financial planning process.

15. International — Non-domestic Carrier

The demand for globe insurance coverage solutions increases even more globalizations has become Competing Devastation. Most of the market trends come from a mixture of several sources, including new products targeted at global and multi-jurisdictional insurers or buyers.

16. Reinsurance Market Dynamics

Reinsurance market structures evolve due to changing risk profiles, natural catastrophes and regulatory initiatives. Storyboard: Insurers and reinsurer diversify portfolios or enhance risk transfer capital to remain competitive, with the tide – Nearly Full Likelihood

17. Insurance Social Media Marketing

The fact of the matter is that social media can be an effective marketing platform that insurance agents, and even networks of agencies including PIA) should take full advantage. This is especially crucial in the digital-first era where insurers can use social media platforms to interact with policyholders, improve brand visibility and provide real-time customer service.

18. BEFORE COUNTRY: LINES BEFORE CLINCHERS

Insurers have evolved the claim treating methodology using digital tools and automation. This might mean things such as automating workflows, making claims more readable using AI and ensuring that your customers have transparency from start to finish.

19. The Future of Life Insurance

Life insurance is an interesting beast in that it can change over time. That could include living benefits on a permanent policy, or even fieldsags to use with your health & wellness programs. These products are only more important to policyholders as their needs evolve through life.

20. Microinsurance Comes of Age

In this perspective, Microinsurance bridges the lacuna mentioned above by covering market insurable population. This tendency is even more common in emerging markets where it might be too expensive to take on the risk using regular forms of insurance.