Insurance More complex and essential in an ever smaller international trade is the crossroads of global insurance. As an individual looking for coverage, or a business trying to protect its assets beyond borders, knowing how to make your way through the crooked and complex universe of global insurance can help you save time and money – not to mention some future headaches. So, get ready for a guide that will help you capitalize the global insurance marketplace right!

Insurance Understand Your Needs

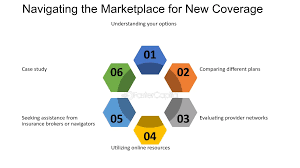

Crowning directly into world coverage market place, it is essential you are aware exactly what the requirements will be. Do you need insurance for yourself, like health or life (or even travel)? Or perhaps you need business coverage such as liability, property or international employee benefits. Once you know what your requirements are, it will be easier for you to filter through their selections and just get the policies that suit YOU.

Find Your Local Insurance Circumstances

There are significant differences in insurance regulations between countries. There are different coverage policies, claims process and standards of provider care for each nation. Acquaint yourself with the regulations that are in place locally of those countries you will be requiring insurance. This will help you make sure that any policy you consider are legal in your area and covers everything as needed.

Compare Worldwide Insurance Providers

Only a few insurance companies have global cover providers in their network. Seek out insurers that specialize in international insurance and/or with networks already built through the regions you need protection. Around the world, scores of known global insurers have resources and experience related to dealing with complex cross-border claims.

That Advice May Be Kept in Mind so Far as Multinational Policies are Concerned

Multi-national insurance policies can provide businesses with simplified solutions no matter where they operate. These are engineered to provide you with more extensive coverage from a single policy spanning multiple territories, thus making it easier manage and potentially saving on costs. Tailoring this policy to your specific international operations and risk profile is crucial.

After you have narrowed down your list on some potential insurers and policies, be very fine-tuned with comparing their coverageㅡthis is the really good stuff. Check the scope of cover, exclusions, limits and premium Check the policy to make sure it covers your risks and will not be full of gaps that can leave you exposed.

Test Claims Administration and Service

As we now know, claims handling is a fundamental aspect of insurance that needs thorough support. Check into the insurer’s claims processing and customer service reputation When processing claims across the globe, a provider with speedy and comprehensive means of handling those aspects can make all the difference.

Seek Professional Advice

Moving around in the international insurance market(Property Name) By speaking with insurance brokers and advisors, particularly those who have experience in this subject field, you can gain some insight for what kind of steps lead pen testing companies to choose their coverage limit. This team of professionals can explain the intricacies of a range of policies and programs, allowing you to compare various options side by side so you know what is best for your coverage.

Stay Updated on Global Trends

The Insurance Market is a fast-paced, constantly changing environment that spans across the globe as new trends and regulations emerge. Keep up with international law developments for insurance, emerging risks and trends in new products. Taking an inventory of your insurance policies and updating as needed can ensure you are covered and current upon changing life circumstances.

- Regular Review and Adjust Your Policies

This way insurance demands could change as you may progress in life and alter your personal situation, business running or global conditions. Re-assesses policies regularly to ensure they still meet your needs and adjust where needed. Taking a proactive approach ensures continued safeguards and the best possible reference data coverage.

- Leverage Technology

The internet and modern tech have transformed the insurance game, making it simpler for people to research global coverages, compare what they find easily and then buy them. Make use of the online tools, Comparison websites and digital platforms from insurers that will reduce your effort to search in rather you can mange all on a single platform.

Conclusion

Gaining success in the global insurance marketplace requires careful thought and a plan. So, knowing your requirements, researching the regulations and providers is very important that will help you to get a better indemnity for your personal or business needs. Be proactive and knowledgeable in managing all your global indemnity demands to ensure you, or the company you own are shielded from the still-changing international marketplace.