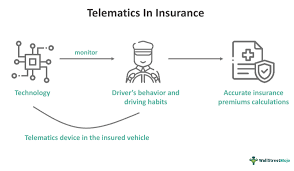

Telematics, a technology that transmits data back to insurers from the cars they insure is beginning to reshape the global car insurance industry. Fuelled by the increasing need for more targeted and efficient insurance products, telematics is becoming a major disruptor.

Understanding Telematics

Improved risk assessment: Telematics gives insurers access to real-time data which enables them assess the level of risk policyholders pose in their term. Ultimately, all of this together results in more accurate predictions about potential claims that are vital for insurers to be able to re-price their portfolios

Increased customer engagement: Telematics allows the driver to access insights in his driving behaviour, leading to a rise in better customer engagement. This activity transforms those efforts to build-to-insurer relationships into a more customer-centric result.

This in turn expedites the claims process, reduces conflicts and results in fairer outcomes. Through real-time data, insurers can help emergency callouts and more immediately provide roadside assistance.

Challenges and Considerations

Pros & Cons of Telematics

Not every vehicle comes with built-in technology and drivers are often resistant to new technologies anyway, [especially in free-with-order contexts] — even without telematics.

Regulatory Hurdles: Telematics, and Data usage is regulated differently in every country.

Read the blog: The Future of Telematics in Auto Insurance 4 min read

The union of telematics with other technologies like autonomous driving will create new avenues for insurance innovation.

In the auto insurance, industry telematics will continue to increase in significance and be at the forefront of what comes next globally.

2/2

give 1

ChatGPT

Sure! A QUICK LOOK AT THE ARTICLE

The Global Auto Insurance Industry Gets Disturbed by Telematics

Telematics, a technology that transmits data back to insurers from the cars they insure is beginning to reshape the global car insurance industry.